What are bank verification documents?

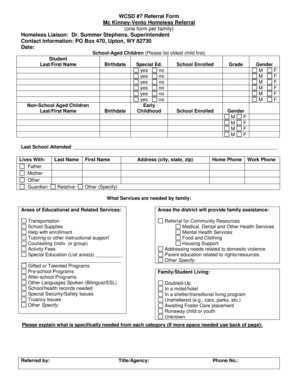

A scanned copy of a government-issued ID is required to complete banking verification. Examples of accepted photo identification: passport, driver's license, state-issued ID, military ID. Expiration date must be valid.

What does a bank verification do?

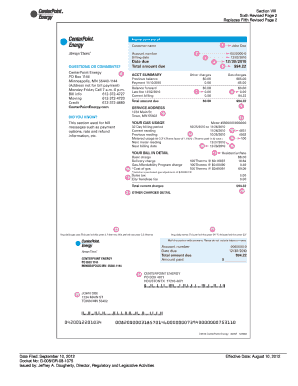

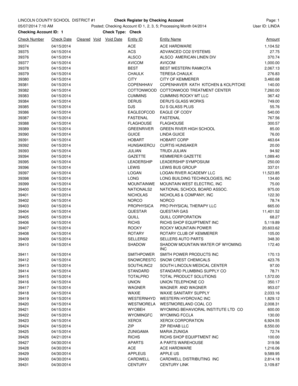

What is bank account verification? In short, bank account verification is a way to check that a customer using your service is the same person named on the bank account they're paying from. It usually involves the customer providing credible information that proves their account ownership, such as a bank statement.

How do you get a bank verification?

How do you verify a bank account? Micro deposits: a customer gives their account details to a merchant. Sending bank statements: a customer provides a merchant with documents from their bank. Credit checks: a merchant checks their customer's account details against the information held on file at a credit bureau.

How do I get a bank verification document?

To obtain a bank confirmation letter from your bank you may request in-person at a bank branch from one of the bankers, by a phone call to the bank, and depending on the financial institution, through their online platform.

What is a bank verification letter?

A bank confirmation letter (BCL) is a letter from a financial institution validating that a borrower has an existing loan or line of credit. A BCL verifies that the individual or company has the means to borrow a specific amount of money for a specific purpose.

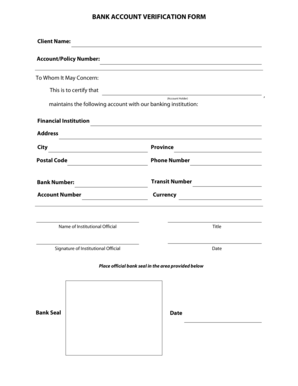

What is needed for bank verification?

The user does not need to go to a branch or speak to an agent. They can carry out the verification and account opening process online through a 100% digital and automated registration and identification process that will ask them to verify their identity document (passport, ID card…), their identity, and proof of life.

How do I download a bank verification letter?

How to download a bank verification letter Navigate to the Accounts tab. Select the checking account for which you want a bank verification letter. Select the Three Vertical Dots beside the Add Money button. Select Request Bank Verification Letter from the dropdown menu.

What is needed to verify a bank account?

What is an acceptable document to verify my bank account? A bank encoded deposit slip with pre-printed details of your bank account. name and number. A copy of a cheque for your bank account. A copy of a bank account statement. A verification letter or other document of confirmation provided by your bank.

How long does it take to get a bank verification letter?

The letter is usually sent to the branch within 1-3 days where the bank executive can print it for you to save on mailing time. You need to pick up the letter in person from the bank. If it is a joint account, then your joint account holder (like your spouse) can also pick up the letter from the bank branch.

How do I get a bank letter for direct deposit?

In-person: The quickest way to obtain a bank letter is to request one in-person. By doing so, you'll be able to ensure that everything you need is on the letter & be able to make changes if necessary. By phone: Another convenient way to obtain a bank letter is to call your bank's support line.

Can I get a bank confirmation letter online?

The bank letter is available through Standard Bank Online or on your Mobile Banking App. Click on the specific bank account you require an account confirmation letter for. Choose to download or email it to yourself.

How do I get a bank verification letter online?

The most efficient way to obtain your bank account verification letter is to contact your bank's customer service department. (Another option is to reach out to them via online chat.)

How do I get a bank verification form?

To obtain a bank confirmation letter from your bank you may request in-person at a bank branch from one of the bankers, by a phone call to the bank, and depending on the financial institution, through their online platform.

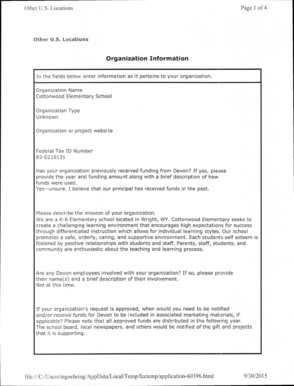

What is a bank verification form?

A bank verification form is a document used by financial institutions to verify account information. A bank or other financial institutions can use a bank verification form for account transactions. This form can help to confirm the borrower's related information along with the representative's verification.

Banks verify documents by running important details like the serial number or date of birth against a government-backed database before approving a loan and other important processes. This process is usually outsourced to online identity verification services like Youverify.

How do I get a bank verification letter for direct deposit?

How To Request/Obtain A Bank Letter In-person: The quickest way to obtain a bank letter is to request one in-person. By phone: Another convenient way to obtain a bank letter is to call your bank's support line. By email: Depending on your bank, you may be able to request a bank letter via email.

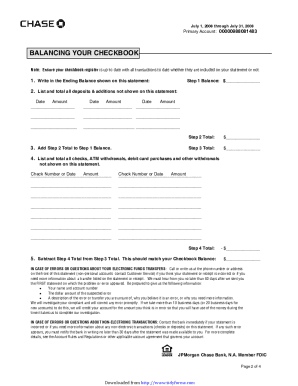

How do I get a direct deposit verification?

Get a direct deposit form from your employer. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.